SFS achieves good result in challenging 2024 financial year

Ad hoc announcement pursuant to Art. 53 LR – March 7, 2025

The 2024 financial year saw the SFS Group operating in a challenging economic environment characterized by uneven business performance and ongoing inventory destocking in individual end markets. With sales of CHF 3,039.0 million, an EBIT margin of 11.6% and major progress in the area of sustainability, the Group achieved most of its targets. SFS is in a robust and good position to meet the current economic challenges and any opportunities that arise.

The challenging environment of the first half of 2024 improved to a lesser degree than expected in the second half of the year. Global economic momentum fell short of expectations throughout the entire reporting period, primarily due to geopolitical tensions and economic uncertainties that resulted in lower rates of investment on the international stage as well as subdued demand.

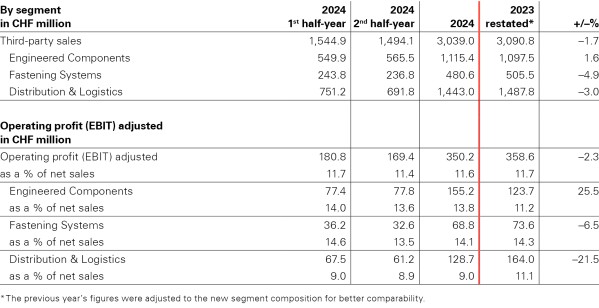

SFS generated third-party sales of CHF 3,039.0 million and organic growth of 0.1% in the 2024 financial year. Persistently strong negative currency effects impacted the result by –1.9%. Overall, this results in a sales decline of –1.7% compared to 2023.

Consistent financial performance

Mix effects, lower utilization of production capacities in the Fastening Systems (FS) and Distribution & Logistics (D&L) segments, a cost base that remains elevated due to inflation, and the ongoing appreciation of the Swiss franc all had an impact on profitability. Operating profit (EBIT) came to CHF 350.2 million (PY CHF 358.6 million) and the resulting EBIT margin to 11.6% (PY 11.7%) in the period under review.