SFS is well on its way to achieving the targets it set for the 2024 financial year

Ad hoc announcement pursuant to Art. 53 LR – July 18, 2024

The SFS Group continued to navigate a challenging economic environment in the first half of 2024, one marked by inconsistent business performance and inventory reductions in individual end markets. With sales of CHF 1,544.9 million and an EBIT margin of 11.7%, SFS is well on its way to achieving the targets it set for the 2024 financial year. SFS continuously strives to push sustainability forward. CO2 emissions were further significantly reduced thanks to an increased share of purchased renewable energy.

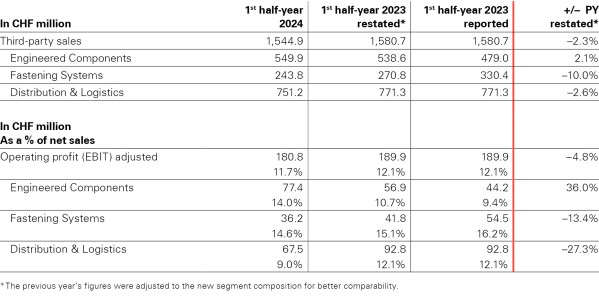

Like in 2023, global economic growth fell short of its potential in the first half of 2024. Reasons for this include the weak international economy, geopolitical tensions and the associated lower investment demand. The results in SFS’s individual business areas felt the impact of the challenging environment to different degrees. While all the divisions in the Engineered Components segment improved over the previous year, the repercussions of this environment were still quite noticeable in the business with construction customers (Fastening Systems segment) and industrial manufacturing customers (Distribution & Logistics segment).

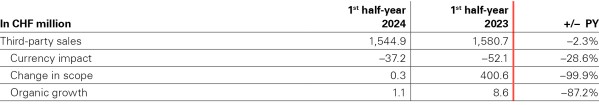

The SFS Group generated third-party sales (sales) of CHF 1,544.9 million in the first half of 2024. This corresponds to a year-over-year reduction of –2.3%. Currency effects reduced sales growth by –2.4%. Organic growth of 0.1% was achieved on a like-for-like basis.