SFS stays well on track in the financial year 2023

Ad hoc announcement pursuant to Art. 53 LR – March 7, 2024

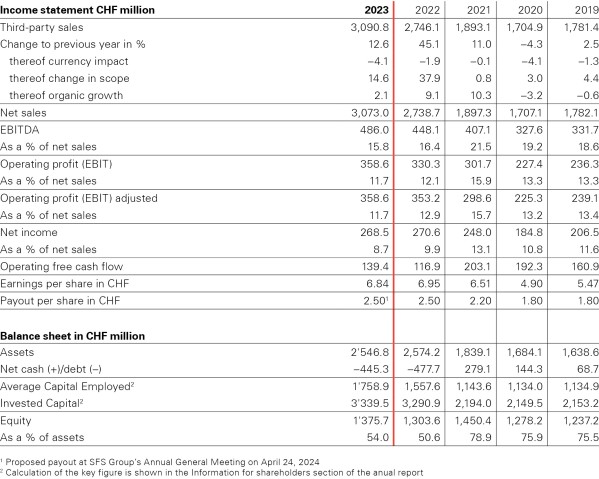

The SFS Group achieved a stable development despite a difficult economic environment. It met its defined financial targets, recording third-party sales (sales) of CHF 3,090.8 million and an EBIT margin of 11.7%. The high level of investment in the realization of growth projects is proving to be worthwhile and focused. SFS also made further important progress in the area of sustainability and is set to meet its targets for education and training, as well as reducing CO2 emissions.

Geopolitical and macroeconomic developments had a major impact on our business activities in 2023. Key leading economic indicators deteriorated considerably over the course of the year. Many customers reduced their inventories as a result of the normalization of supply chains after COVID-related disruptions, aggravating the situation further. The course of business over the last 12 months reflects this through inconsistent results in the various end markets.

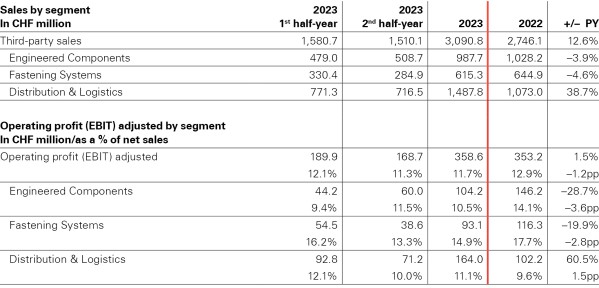

In the financial year 2023, SFS generated robust organic growth of 2.1%. Sales increased overall by 12.6% to CHF 3,090.8 million. Consolidation effects stemming from the inclusion of Hoffmann as of May 1, 2022, accounted for 14.6% sales growth. Strong currency effects negatively impacted the development by –4.1%. On a like-for-like basis, sales growth amounted to 0.8% year-over-year in the first half of the year and 3.2% in the second half.

Profitability significantly impacted

Consolidation and mix effects stemming from the inclusion of Hoffmann as of May 1, 2022, inconsistent utilization of production capacities in the Engineered Components segment, the occasionally higher cost base due to inflation, and the ongoing appreciation of the Swiss franc all had an impact on profitability. Operating profit (EBIT) came to CHF 358.6 million (PY CHF 330.3 million) and the resulting EBIT margin to 11.7% (PY 12.1%) in the period under review.