SFS seizes opportunities in the financial year 2022

Ad hoc announcement pursuant to Art. 53 LR – March 3, 2023

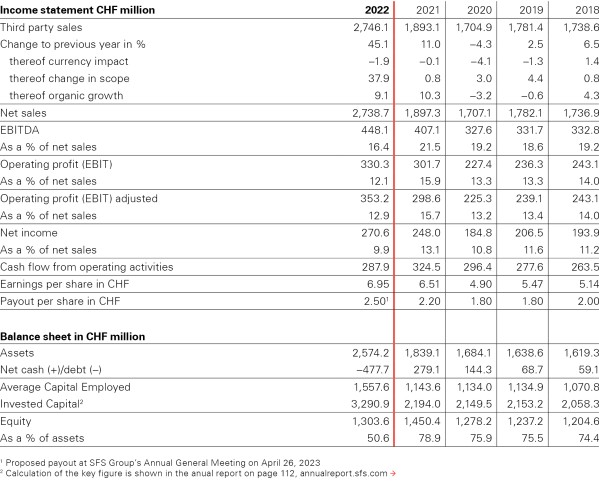

In 2022, the SFS Group generated sales of CHF 2,746.1 million in a market environment characterized by geopolitical and macroeconomic events. The strong growth of 45.1% was driven both organically and by the inclusion of Hoffmann. SFS boosted its operating profit (EBIT) by 9.5% to CHF 330.3 million, which corresponds to an EBIT margin of 12.1%. Adjusted for acquisition related one-off effects, the EBIT margin amounts to 12.9%.

SFS Group looks back on a year characterized by geopolitical and macroeconomic events. With the acquisition of Hoffmann, SFS seized the extraordinary strategic opportunity to secure an internationally strong position in the attractive area of quality tools. The considerable uncertainties and high volatility attributable to the war in Ukraine, sustained disruption in supply chains, further waves of COVID-19 as well as sharply rising energy costs, interest rates and inflation were constant companions during the entire reporting period. Thanks to local production sites, largely regional and therefore robust supply chains, an impressive product range as well as our employees’ enormous commitment, SFS has managed to maintain the ability to deliver to customers with just a few exceptions and gain market share in several business areas.

SFS generated good organic growth of overall 9.1% in most end markets and regions throughout 2022 as a whole, achieving third party sales of CHF 2,746.1 million. That corresponds to a strong year-over-year increase of 45.1%. Consolidation effects that mainly arose as a result of the inclusion of Hoffmann as per May 1, 2022, accounted for 37.9% of the growth surge. Currency effects negatively impacted sales by –1.9%.

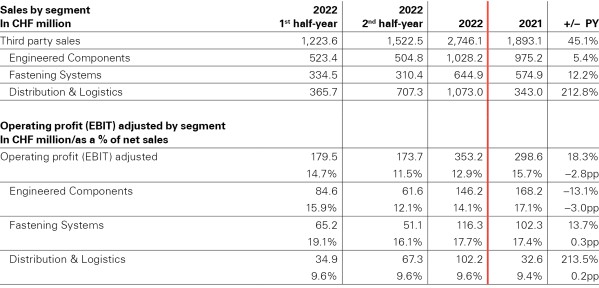

Profitability significantly impacted by mix effects

Hoffmann’s consolidation significantly impacted profitability in different ways: Whereas operating profit (EBIT) saw a substantial increase, the business model in the Distribution & Logistics segment comes with a lower EBIT margin that, in turn, reduces the Group's consolidated EBIT margin. The volatile and occasionally lower utilization of capacities weighed on profit in the Engineered Components segment. All in all, this resulted in an operating profit (EBIT) of CHF 330.3 million and an EBIT margin of 12.1% of net sales (PY 15.9%). The reported result is weighed down by increased material expenses of CHF 22.9 million due to acquisition effects. Accounted for these acquisition effects, the adjusted EBIT margin amounts to 12.9%. At CHF 270.6 million (PY CHF 248.0 million), net income corresponds to 9.9% of net sales. An operating free cash flow of CHF 116.9 million (PY CHF 203.1 million) was achieved during the financial year. The realization of earnings per share (EPS) of CHF 6.95 (PY CHF 6.51) clearly underpins the financial attractiveness of the transaction with Hoffmann, especially in light of the negative impact of acquisition effects. The equity ratio rose by 3.9 percentage points to 50.6% compared with the closing date of the half-year report.